By Dr Olivia Ogilvie, Analyst

Traditionally, deep tech ventures have lacked the necessary investment, but the rapid global and domestic growth of the sector has seen investor interest and risk appetites increase. Deep tech start-ups are a high-risk class of investments that can also deliver high returns.

“From 2016-2020, private investment into deep tech entities grew more than 20% year-on-year, from $15B to more than $60B globally.”

Hello Tomorrow and BCG Report on Deep Tech: The Great Wave of Innovation

In Aotearoa New Zealand the past three years have seen a 20% year-on-year increase in the amount of money invested into start-ups locally, with 2020 peaking at $158 million into 108 deals, as highlighted in the PwC Startup Investment New Zealand Series. In the first half of 2021, total investment in the early-stage sector increased 78% from the first half of 2020, with 42% of the funding going towards deep tech start-ups. This increased funding reflects multiple factors, including increased liquidity in the market (due to private funding and government initiatives), a general maturing of the ecosystem, and the recognition that high-innovation technologies have the potential to make disproportionately positive impacts on society.

What makes deep tech investment different?

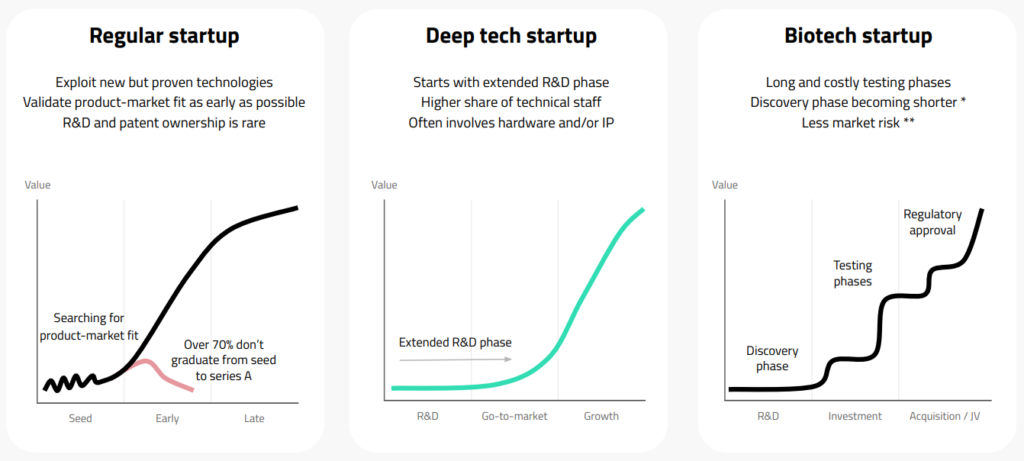

Unlike traditional start-ups which are primarily associated with market risks, deep tech companies have the added factor of technology and engineering risks. As a result, their growth and funding patterns are slightly different to traditional start-ups. Deep tech companies generally require more investment as more time and effort is needed to conduct research and development before it is ready to enter the market.

Deep tech start-ups have a long phase of technology development or R&D before market development which is fundamentally different from other start-ups like software-based companies or drug development companies. This long R&D phase is often marked with technology-focused, resource-intensive milestones, meaning the early funding rounds are often larger than software-based start-ups. This also means the investment horizons of investors targeting deep tech often need to be around 10-15 years, whereas traditional venture capital funds usually have a return expectation of 10 years. However, the end product of a deep tech company may be worth more, which means larger returns for investors.

Who’s investing in deep tech in Aotearoa New Zealand?

In general, most investment funds target a specific sector like deep tech, SaaS, fin-tech or pharma/bio-tech. This is because the commercial pathway, funding requirements, risks and skill sets required to succeed differ between each sector (as highlighted above). Investors tend to work with the sectors that they know and understand, and where they are more likely to make good decisions.

Several funds in Aotearoa New Zealand target deep tech at various stages of venture capital investment, from early (pre-seed and seed) to later (Series A, Series B and beyond). Along with capital, each fund offers a unique set of skills, experience, and approaches. For example, active investors provide operational and strategic support alongside their financial investment, while others are passive, offering only capital.

Matū’s investments

Matū contributes value beyond the dollar by investing both financial and intellectual capital, going beyond light touch governance to bolster portfolio companies’ likelihood of success. By actively engaging and working with researchers, developers, founders, and entrepreneurs at an early stage to build ambitious ideas into successful start-ups, Matū’s active business support includes strong governance, development of management and strategic capabilities, IP strategy and support, operational support, and commercial

deal-making expertise.

In just three years, Matū has grown a strong investment portfolio of 12 companies, reflecting the diversity of the science and deep tech innovation within Aotearoa New Zealand. Some recent portfolio company performances and investment highlights include:

Mekonos, a company revolutionising cell therapy, recently completed an oversubscribed USD$25 million raise round. The new capital will accelerate the development of Mekonos’ “system on a chip”, expand commercial partnerships and support talent acquisition.

Alimetry left stealth mode earlier this year to announce they had achieved CE Mark on their wearable diagnostic product, called Gastric Alimetry, which is positioned to transform the diagnostic pathway for millions of patients worldwide suffering from gastric diseases and symptoms. Alimetry was also named a finalist in three categories of the NZ Hi-Tech Awards this year.

Ligar, commercialising high-selectivity extraction and filtering technology, announced a cannabis purification partnership with Maratek in November 2021, working together to use Ligar’s technology to produce a high-quality extract, more efficiently, and more safely than existing methods.

PowerON successfully closed a $3.1 million oversubscribed capital raise to further their mission of bringing soft robotics to the world. This funding will enable them to complete multi-functional prototypes for lead customers and build the global market for their novel sensing, actuation, and computation systems.

Interested in investing in deep tech? Matū is proud to champion this asset class to investors in Aotearoa New Zealand. Matū Iramoe’s initial public offering, is live on Catalist, offering retail investors a unique opportunity to buy into the rapidly growing deep tech sector. The retail offer closes 6pm on 29 November 2021.

Olivia is passionate about the innovation and commercialisation of science, particularly food system engineering, food allergenicity and novel food regulation. Olivia earned a PhD from the University of Auckland in 2020 with her work adding much needed knowledge to the field of celiac disease. Her Postdoctoral Fellowship is on cellular agriculture with a specific focus on cultured meat. She is an inaugural committee member of Canterbury Momentum.

The information contained in this blog post is published for educational purposes only and is only intended to provide general information or opinions. It does not constitute financial advice or a recommendation of any financial product and should not be relied upon as such. You should not use any information in this blog to make financial decisions and we highly recommend you seek professional advice from someone who is authorised to provide investment advice. While all reasonable care has been taken in the preparation of this blog post, no member of the Matū Group accepts any liability for any errors it may contain.