By Damita Mathew, MBE Intern

Deep tech is on the rise. Viewed as the next big surge of innovation by some, a flurry of disruptive deep tech start-ups has sprung up in recent years, seeking to tackle the globe’s most complex challenges, such as climate change, chronic disease, and sustainable energy production. These start-ups are founded on tangible scientific discoveries, employ novel approaches to real-world problems, and are strongly focused on achieving a positive impact on people and the planet. Encompassed within this wave are companies tinkering with artificial intelligence, advanced materials, synthetic biology, robotics, and quantum computing, among other advanced technologies.

The Missing Piece: New Zealand’s deep tech ecosystem faces a lack of capital

Early-stage investment is pouring into deep-tech start-ups worldwide, with private investment in these ventures swelling from $USD 15 billion in 2016 to over $USD 60 billion in 20201. In New Zealand, deep tech has also witnessed increased popularity from early-stage investors, having received 41% of our country’s total start-up investment in 20212.

However, when comparing our level of investment to other smaller nations with growing deep tech sectors, we are punching below our weight. On a per capita basis, private investment in New Zealand’s early-stage deep tech ecosystem in 2021 stood at $USD 13, while that level for places like Israel, Singapore, Sweden, Switzerland, Finland and Norway ranged between $USD 153 to $USD 2,4702,3,4.

New Zealand’s early-stage deep tech ecosystem is still maturing relative to the larger deep tech ecosystems overseas, which can somewhat explain this low level of investment. However, a key issue lies in the lack of available capital, as opposed to a lack of ideas or high-growth start-ups. Consequently, local deep tech start-ups seeking funding to commercialise their technologies may look overseas in search of more capital-rich waters. Identifying additional sources of capital within New Zealand is needed to retain these start-ups locally and to establish New Zealand as a key player in technology commercialisation.

A Potential Match: Iwi Investment as a new source of capital

One potential means of introducing additional capital into New Zealand’s early-stage deep tech ecosystem is through Te Ao Māori. Since 1992, 75 Iwi have finalised Treaty settlements with the Crown to compensate Māori for their significant losses caused by the Crown’s breaches of the Te Tiriti o Waitangi/The Treaty of Waitangi. These Treaty settlements, alongside assets already owned by Iwi in New Zealand, have led to a thriving Māori economy worth an asset value of $NZD 70 billion in 2022, projected to be steadily growing at 5% per year5. To manage these assets, Iwi have established Iwi-governed investment arms.

Iwi investment entities currently have low exposure to deep tech. Still, the close alignment of Iwi investment mandates and deep tech’s environmental, social, and financial characteristics recognised in the literature suggests that this asset class may be an attractive option for Māori to invest in. However, details on the investment activity of Māori in the literature have remained largely unexplored. Liam Rollo (Te Aupōuri), a Masters of Bioscience Enterprise intern with Matū, under the industry supervision of Dr Andrew Chen and Dr Will McKay, recently conducted a study on the pairing of Māori investment and early-stage deep tech.

Particularly, Liam set out to explore the following question: “What are the drivers and barriers towards the participation of Iwi investment into New Zealand’s early-stage deep tech ecosystem?” To help answer this, nine in-depth interviews were conducted with relevant stakeholders in the Iwi investment space, including Iwi investment managers, Iwi board members, and corporate investment managers, alongside a review of several SIPOs and investment mandates, with the findings thematically collated and analysed.

Marrying the Two: The Drivers & Barriers

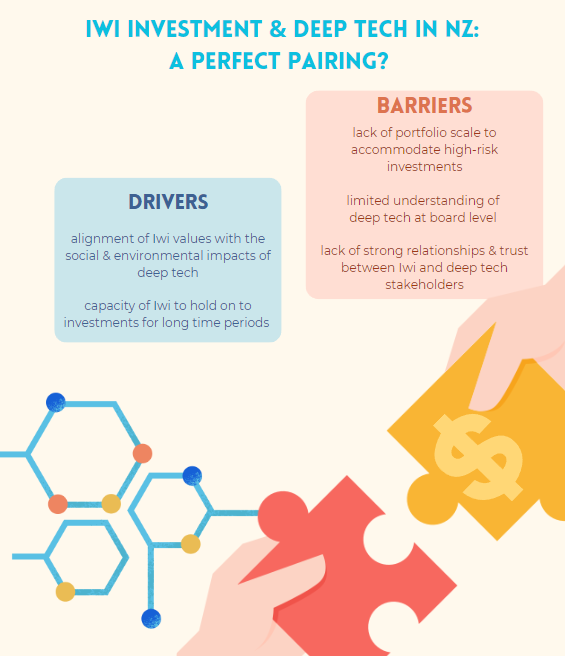

Emerging from this analysis were several key drivers and barriers influencing Iwi investment activity in the early-stage deep tech space.

Key drivers promoting Iwi investment into deep tech include the alignment of Iwi investment mandates with the positive social and environmental impacts of deep technologies, particularly those that “can help level the playing field” for Māori such as improving health outcomes or creating value-add for traditional Māori industries. Additionally, the approach of Iwi to hold on to investments for long time periods (intergenerationally) supports the intensive research & development phases that require a long time-to-market for many deep tech start-ups.

On the other hand, key barriers objecting to this pairing include:

- A lack of portfolio scale for many Iwi investment arms to accommodate such high-risk investments, given the impact of risk on portfolio allocation and the fragmented nature of Iwi investing

- A limited understanding of the asset class at Board level, and a current lack of incentive to build relationships in the sector when there are other industries and asset classes to focus on

- An absence of strong relationships and trust between Iwi and key stakeholders in the New Zealand early-stage deep tech ecosystem

The Implications

The above findings hold several significant implications. Academically, Liam’s thesis contributes to the current gap in the literature surrounding Māori investment activity by exploring the values of Iwi investment groups influencing their assessment of an investment opportunity. These include tikanga (intrinsic values), such as manaakitanga (the ethic of care) and kaitiakitanga (guardianship of the environment), alongside commercial priorities, such as a need for cash flow to enable consistent returns to beneficiaries and funding of Iwi social programs, and a general low appetite for risk.

Ways for stakeholders (e.g., deep tech founders, venture capitalists, and government bodies) in the deep tech ecosystem to overcome the hurdles identified in this study are also outlined, including supporting Iwi portfolio balancing and diversification, and bringing expertise in deep tech onto Iwi investment boards. Further highlighted is the potential of establishing a government intervention to match Iwi investments in deep tech, or a collective investment approach in a portfolio of deep tech companies by multiple Iwi to achieve sufficient scale.

The study’s analysis of the key challenges associated with Iwi investment into deep tech can also support Iwi in assessing how suitable a pairing with this asset class would be and, if attractive, what adaptations can be made to facilitate these investments.

Important to note are the study’s limitations. Due to time constraints, the above findings are drawn from a relatively small number of interviews. Moreover, as many participants were recruited through connections within NZ’s deep tech industry, a greater bias for participants favouring Iwi investment into deep tech becomes more likely. There is, therefore, room for broader conversations in this space. To further strengthen the ties between Iwi and the deep tech ecosystem, it would also be valuable to closely examine how Iwi form their business relationships with deep tech stakeholders.

It is hoped that with this research, more funds may become available through Iwi investment arms and Te Ao Māori as an additional source of financial capacity to enrich New Zealand’s deep tech ecosystem. The potential union of the two may just be what is needed to help retain the country’s most innovative and fast-growing start-ups.

Damita Mathew is a research intern with Matū in 2023, and is currently completing her Masters in Bioscience Enterprise at the University of Auckland. She has a background in biomedical science and has previously worked with the Auckland Bioengineering Institute on quantitative and qualitative market validation of medical devices.

1 https://hello-tomorrow.org/wp-content/uploads/2021/01/BCG_Hello_Tomorrow_Great-Wave.pdf

2 https://www.nzgcp.co.nz/assets/Media/startup-investment-report-autumn-2022_sml.pdf

3 https://medium.com/angularventures/enterprise-deep-tech-vc-in-europe-israel-2021-43b35512f43

4 https://www.pwc.com/sg/en/financial-services/assets/tech-startup-funding-trends-and-outlook.pdf

5 https://www.treasury.govt.nz/sites/default/files/2022-07/oia-20220059.pdf